Want to Get Access to AML Experts and Expand Your Network?

Benefits of Joining the AFC Ecosystem

-

1

Break Down Silos

The AFC ecosystem breaks down silos by bringing a community of AFC experts together who share knowledge and experiences to combat financial crime. -

2

Build Better Systems

By working together, you can add new scenarios to your AFC solution thereby increasing its effectiveness in detecting suspicious activity.

-

3

Stay Ahead of Threats

Financial criminals are evolving and developing new techniques. By sharing knowledge, the AFC Ecosystem ensures that you are always aware and one-step ahead of those criminals.

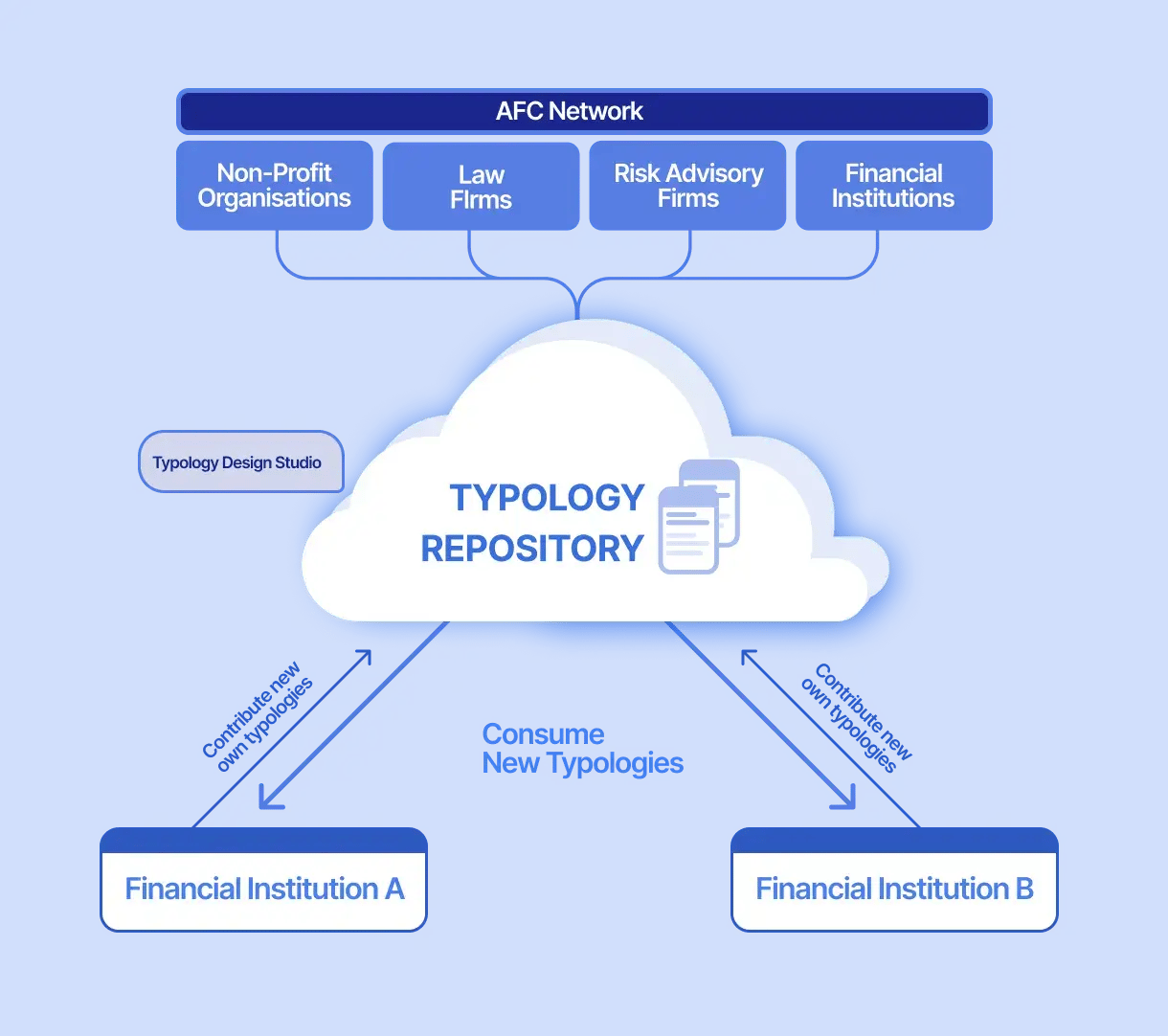

Architecture of the AFC Ecosystem

Typology Repository

It is a living database of money laundering techniques based on real world red flags. The typologies are curated by a global network of SMEs who are the AFC Ecosystem members.

“No Code” Typology Design Studio:

Design typologies based on real world red flags with an intuitive drag-and-drop interface. Create suspicious financial patterns without defining thresholds and property values.

The AFC Network

The AFC Ecosystem brings together experts from financial institutions, regulators, non-profit organizations, and AFC experts to tackle financial crime.

Make the World a Safer Place

Frequently Asked Questions

Have Question? We are here to help

What is the Tookitaki AFC Ecosystem?

How can the Tookitaki AFC Ecosystem help my business?

You can access the latest AML and fraud scenarios (typologies) to protect you from emerging threats. The AFC Ecosystem leverages the community to collate the financial crime scenarios. Thus responding to regulatory changes or new fincrime patterns with an unmatched speed.

What kind of data and analytics does the Tookitaki AFC Ecosystem provide?

It provides actionable insights derived from federated learning, including typologies and risk assessment analytics, that help in effective decision-making.

How easy is it to use the Tookitaki AFC Ecosystem?

The platform is designed for user-friendliness, offering intuitive dashboards and automated features to simplify information sharing.

What kind of customer support is available for users of the Tookitaki AFC Ecosystem?

Tookitaki offers robust customer support including technical assistance, training programs, and a dedicated team to assist with any challenges.

How can I book a demo and learn more about the Tookitaki AFC Ecosystem?

To book a demo and get more information, talk to one of our experts.

.png?width=200&height=83&name=PNG%20-%20Montserrat%20LOGO%20-%20a%20Thunes%20company%20(White).png)