We live in a digital world where the threat of money laundering is both increasing and evolving in unprecedented ways and scale. Financial institutions are finding it tough to compete with financial criminals and their sophisticated schemes. In order to establish a robust anti-money laundering (AML) compliance program, it is important for financial institutions to have a first line of defence that monitor, investigate and report suspicious activities. The setup normally involves a combination of technology and staff. Financial institutions rely on a single solution or multiple solutions that monitor and screen transactions, accounts and customers, and generate alerts based on defined rules and thresholds. Once alerts are generated, AML investigators use documented risk-based policies and human judgement to determine if an alert is truly risky.

In present times when AML systems generate several thousands of alerts every month and most of the alerts being identified as no-value alerts (often referred to as false positives), it is becoming increasingly difficult for the compliance team to both keep deadlines and correctly identify cases that matter. Research says that banks are wasting more USD 3.5 billion per year chasing false leads because of outdated AML systems that rely on stale rules and scenarios and generate millions of false positives.

Having stated the problem, we are trying to explain here the potential of artificial intelligence (AI) in alerts management with a real-life use case.

Why is AML Alerts Management Important for Compliance?

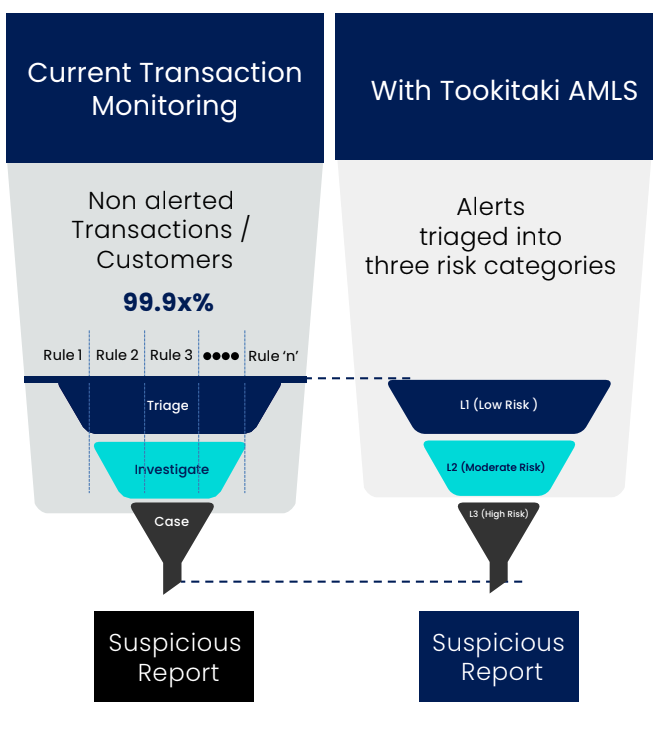

AML alert management is the process in which a financial institution scrutinizes each and every system-generated alerts for potential suspicious activity. The process helps in separating alerts between those can be ignored and those should be investigated. Having a greater responsibility to participate in AML regulations and facing stricter scrutiny for AML compliance, the financial sector takes alert management seriously and adopts multiple methods to mitigate AML risk. However, the sector is facing one monster of a problem at the moment. As today’s financial institutions deal with millions of daily transactions, several thousands of routine financial transactions are being flagged every month, leading to a whopping number of unproductive alerts. In order to deal with the high rate of false positives generated by their solutions, financial institutions generally adopt a three-tier investigation approach:

- Triage all alerts to eliminate activity that can be easily classified as ‘no risk’.

- Investigate remaining alerts further to eliminate activity deemed not suspicious and aggregate common alerts into cases.

- Case investigation for investigative financial crime analysis to gather additional information and make informed decisions as to whether to file a Suspicious Activity Report (SAR)/Suspicious Transaction Report (STR).

While this approach provides some cost efficiency in leveraging most senior staff to only cases, it is unable to determine the relative risk of individual alerts and adds tremendous operational pressure to AML teams. Research has shown that the average SAR is filed more than 5 months after the suspicious transactions occur. In addition, the approach triples the touches an alert needs to be reviewed to become a suspicious report. Combined, these misses become inhibitors to the prevention of financial crime.

AI Transformation for Worrisome AML Alert Management Problems

AI has brought in disruption in many industries with its ability to mine, structure and analyse huge volumes of data and provide actionable insights. AI can take up repetitive tasks, saving valuable time, effort and resources that can be redirected perform higher-value functions. From an AML compliance perspective, AI can extract risk-relevant information from large volumes of data and present that information in a better coherent manner, making the process of identifying high-risk transactions and clients even easier in the fight against financial crime. The process inefficiencies in AML alert management can be reduced significantly by using the power of AI in the following ways:

- Reducing manual efforts and saving time: In order to go through each and every AML alert, compliance departments within financial institutions need an army of resources. Considering the ever-increasing number of alerts within these institutions, it is not a feasible and sustainable option for institutions to increase the number of skilled and costly compliance staff. AI can effectively automate repetitive tasks, saving a lot of man-hours for financial institutions and eliminating alert backlogs.

- Optimal use of scarce compliance resources: Prudent use of skilled compliance staff is vital for compliance departments today. The compliance staff have been given the task of finding out the needle in the haystack and are wasting most of their precious time in closing low-risk alerts. With advanced machine learning, alerts can be grouped based on risk levels so that more time and talent can be dedicated to those that matter.

- Augmenting process efficiency and accuracy: Heavy workloads can cause distractions and human errors within AML compliance teams, elevating regulatory risk. While AI cannot replace human judgment in the AML compliance process, it can assist humans with predictions, recommendations and powerful analytics, enabling faster and accurate decision making.

Today, the banking and financial services industries are realizing the power of AI and Machine Learning in preventing sophisticated money laundering. Surprisingly, the adoption of AI and Machine Learning is being slowed not by the exceptional improvements the tools provide but with how and where humans and AI work together to drive better outcomes.

Tookitaki’s AI Revolution in Alert Management

Tookitaki developed Anti-Money Laundering Suite (AMLS), a next-generation solution that is powered by advanced Machine Learning and Big Data analytics. AMLS is purpose-built to cut through the noise and clutter generated by legacy AML transaction monitoring and screening processes. It provides an automated alert triaging function, called Smart Triage management. AMLS is validated by leading global advisory firms and banks across Asia Pacific, Europe and North America.

AMLS Smart Triage management learns from historical data and investigative outcomes to build a highly accurate ML model to differentiate alerts into three AML risk levels – Minimal Risk (L1), Low Risk (L2) and High Risk (L3). These categories effectively replace the traditional triage function. The highly accurate alert classification helps compliance teams to allocate time and experience judiciously and effectively address alert backlogs. Compliance analysts can now focus on those high-risk cases (L3 and L2) that require more time to investigate and close. Meanwhile, they can close low-risk alerts (L1) with minimal investigation. AMLS generates a probability score for all alerts, along with an explanation to guide the investigator to make the right decision faster.

Transaction Monitoring Today and with Tookitaki AMLS

AMLS Smart Triage management complements the existing rules-driven primary systems and can be operationalized easily, following risk-based protocols.

Our Experience with a Large Asian Bank

Recently, our AMLS solution went live within the premises of United Overseas Bank (UOB), one of the top 3 banks in Singapore, making us the first company in the APAC region to deploy a complete AI-powered AML solution in production concurrently to transaction monitoring and name screening. By deploying AMLS, UOB could effectively create workflows for prioritizing alerts based on their risk levels to help the compliance team focus on those alerts that matter.

The use of a standard framework for AML alert management with common filtering tools based on static rules and thresholds would lead to operational constraints such as a high number of false positives to be manually addressed, low SAR/STR rates and labour-intensive case analysis. By using machine learning and advanced data analysis techniques, compliance analysts can better manage their time and increase productivity. They can help save time spent on the release of false positives and manual case analysis, ensuring an enhanced, secured and robust AML alert management framework.

Financial criminals are adapting and evolving money laundering techniques at an accelerating pace. While the benefits of AI are obvious, it is now time for financial institutions to embrace next-generation solutions in order to maintain the safety and soundness of the global financial system. With our proven data-driven, risk-based approach, financial institutions of any size across the globe can effectively move away from static rules-based approaches in AML monitoring. Tookitaki AMLS delivers machine learning in an off-the-shelf package solution that learns over time and provides the functionality to maintain a compliant AML program.

For a demo of our award-winning solution, please get in touch with us.

Anti-Financial Crime Compliance with Tookitaki?

.png?width=250&height=104&name=PNG%20-%20Montserrat%20LOGO%20-%20a%20Thunes%20company%20(White).png)

-1.png?width=200&height=83&name=PNG%20-%20Montserrat%20LOGO%20-%20a%20Thunes%20company%20(White)-1.png)