Among the global anti-money laundering (AML) watchdog’s recommendations, the FATF Travel Rule received a wider attention ever since it became applicable to the cryptocurrency sector. The Travel Rule requires businesses to collect and share the personal data of participants in transactions such as cross-border and domestic wire transfers.

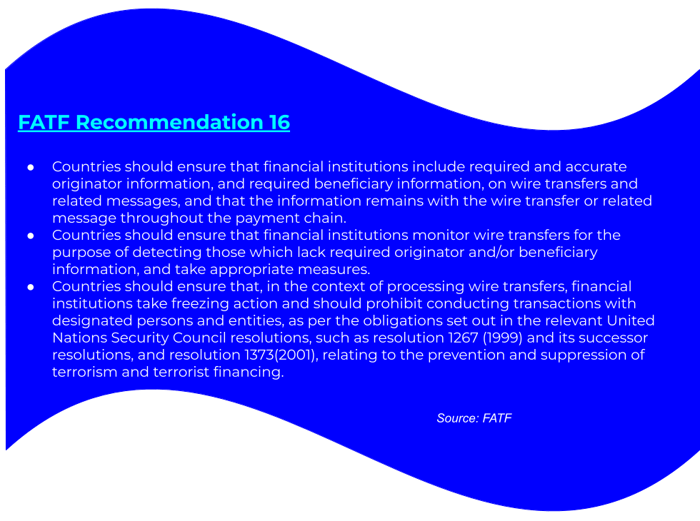

Initially, the Travel Rule or the FATF Recommendation 16 was applicable only to banks. In 2019, the FATF amended the recommendation and brought in crypto companies under its purview. As of now, a small number of jurisdictions have started to incorporate the Travel Rule into their local AML laws. However, many FATF member countries are yet to adopt the recommendation.

It is important for virtual asset service providers (VASPs) and other regulated entities to understand the Travel Rule and the AML compliance obligations involved in it. This article looks to clarify the Travel Rule requirements and suggest how businesses can ensure AML compliance with modern technology solutions.

What is the FATF Travel Rule?

The FATF Recommendation No. 16 on combating money laundering is commonly referred to as the Travel Rule. The rule requires both financial institutions and VASPs to collect personal data, such as names and account numbers, on participants in transactions exceeding US$/€1,000. As such, these firms need to collect personal information of both senders and recipients in a transaction.

The data to be gathered under the rule are physical address, unique ID number, customer identification number, or date and place of birth. In addition, the rule requires firms to share the collected data on senders and recipients among each other while conducting transactions. Since the data of parties travels along with the transfers, this recommendation by the FATF came to be known as the Travel Rule.

Customer information requirements under the Travel Rule

As per the Travel Rule, originators of cryptocurrency transfers must submit the following information to beneficiaries:

- Originator name

- Account number

- Physical address

- Unique identity number

- Date of birth and place of birth

Meanwhile, the beneficiaries in a transaction must submit the following information to originators:

- Beneficiary name

- Account number or virtual wallet number

Why is the Travel Rule significant for Crypto firms?

In June 2019, the FATF recommended crypto firms to follow the Travel Rule in an effort to curb the increasing abuse of crypto platforms for money laundering. As such, all VASPs including cryptocurrency exchanges, digital wallet providers, and financial institutions that exchange, hold, safe keep, convert and sell virtual assets would need to disclose specific customer data when transacting cryptoassets over a particular threshold.

While the transfer of personal data has been a standard practice for banks and credit unions, it is a new and challenging requirement for crypto companies. The challenge is to build a new communication network that connects various crypto platforms.

The FATF noted that it takes a “technology-neutral approach” and did not suggest a particular technology or software approach that providers should deploy to comply with the rule. “Any technology or software solution is acceptable, so long as it enables the ordering and beneficiary institution (where present in the transaction) to comply with its AML/CFT obligations”, it says in its updated guidance issued in October 2021.

The challenges for crypto industry in Travel Rule implementation

While the Travel Rule will help in enhancing the audit trail for transfers within the crypto industry, reducing the anonymity, the implementation of the rule faces many legal and technological challenges. They include:

- Lack of regulatory frameworks regarding the Travel Rule and particularly information sharing in many jurisdictions.

- High costs and significant efforts in building compliance programmes that take into account the rule.

- Lack of global consensus on cross-border crypto transactions

- Laying down clear processes on verifying information, securing information and safeguarding information traveling between specific parties.

- Identification of counterparty VASPs and their registration status

- Hurdles in bringing interrelationships among numerous technologies and channels for crypto transactions such as virtual wallets, P2P exchanges, cryptocurrency kiosks, decentralized applications, ICOs and internet casinos.

In its second 12-month review of the implementation of revised Standards on virtual assets and VASPs, released in June 2021, the FATF noted that most countries have not implemented the Travel Rule. The findings of the review are:

- So far, 58 out of 128 reporting jurisdictions advised that they have now implemented the revised FATF Standards, with 52 of these regulating VASPs and six of these prohibiting the operation of VASPs.

- The private sector has made progress in developing technological solutions to enable the implementation of the ‘travel rule’. However, the majority of jurisdictions have not yet implemented the FATFs requirements, including the “travel rule”.

- These gaps in implementation also mean that we do not yet have global safeguards to prevent the misuse of VASPs for money laundering or terrorist financing. The lack of regulation or implementation of regulation in jurisdictions can enable continued misuse of virtual assets through jurisdictional arbitrage.

The importance of Travel Rule in AML efforts

There is no doubt about the use of cryptocurrencies to facilitate money laundering and other financial crimes. The Travel Rule, by removing the obscurity in crypto transactions, looks to reduce financial crimes through the crypto industry.

Crypto firms that are not currently meeting the Travel Rule requirements will be required to do so in the near future. By complying with these rules, the cryptocurrency industry will transition to a new AML/CFT regime which will increase the goodwill for the industry in front of regulators and customers.

If you are a crypto business that is looking to set up an AML compliance programme, reach out to one of our experts.

Anti-Financial Crime Compliance with Tookitaki?

.png?width=250&height=104&name=PNG%20-%20Montserrat%20LOGO%20-%20a%20Thunes%20company%20(White).png)

-1.png?width=200&height=83&name=PNG%20-%20Montserrat%20LOGO%20-%20a%20Thunes%20company%20(White)-1.png)