Understanding Predicate Offences: The Hidden Web of Money Laundering

The world of financial crimes is a complex web where illicit funds are concealed and laundered to appear legitimate. At the heart of this intricate network lie predicate offences, serving as the foundation for money laundering activities. Understanding the concept of predicate offences is essential in the fight against organized crime and the preservation of the integrity of financial systems.

This article explores the significance of comprehending predicate offences, their relationship to money laundering, and the global efforts to combat these crimes. Delve into the social and economic consequences, the role of law enforcement, technological advancements, and the measures taken by financial institutions to prevent and mitigate such illicit activities.

Understanding Predicate Offences: The Key to Unveiling Money Laundering

The Definition and Scope of Predicate Offences

Predicate offences, also known as underlying offences, serve as the foundation for money laundering activities. These offences encompass a broad range of illegal activities that generate proceeds or funds derived from unlawful sources.

Predicate offences can include various crimes, such as drug trafficking, corruption, fraud, human trafficking, terrorist financing, organized crime activities, and more. The scope of predicate offences extends beyond traditional criminal activities and encompasses emerging areas like cybercrime and environmental crimes.

By identifying and categorizing these underlying offences, authorities can trace the flow of illicit funds and unravel the intricate web of money laundering schemes. Recognizing the diversity and evolving nature of predicate offences is crucial for effectively investigating and preventing money laundering.

Unravelling the Link: Predicate Offences and Money Laundering

Predicate offences and money laundering share an inseparable relationship. Money laundering serves as the mechanism through which the proceeds of predicate offences are concealed, transformed, and integrated into the legitimate financial system. Criminals engage in money laundering to obscure the illicit origins of their funds, making them appear legitimate and avoiding suspicion.

Understanding the link between predicate offences and money laundering is essential for authorities to disrupt and dismantle criminal networks. By targeting predicate offences and subsequent money laundering activities, law enforcement agencies can effectively combat organized crime and disrupt the financial infrastructure supporting it.

The Significance of Identifying Predicate Offences in Investigations

Identifying predicate offences plays a pivotal role in money laundering and organized crime investigations. Recognizing the underlying crimes allows investigators to establish connections, gather evidence, and build cases against the perpetrators.

By focusing on predicate offences, investigators can trace the financial transactions, follow the money trail, and uncover the networks involved. This information not only aids in apprehending criminals but also helps dismantle their operations and seize their illicit assets.

Moreover, identifying predicate offences provides valuable insights into the nature and scope of criminal activities. It enables law enforcement agencies to anticipate emerging trends, adapt their strategies, and implement preventive measures to mitigate the risks posed by these crimes.

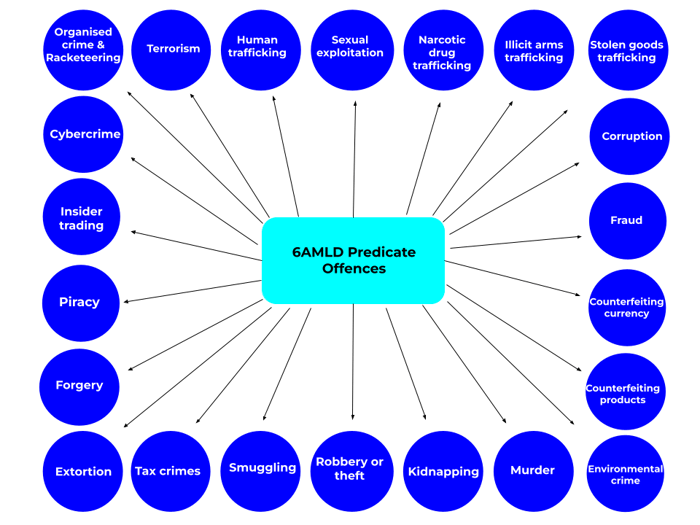

What are the 22 Predicate Offenses in the 6th Anti-Money Laundering Directive (6AMLD)?

On 3 December 2020, the EU Sixth EU Anti-Money Laundering Directive (6AMLD) came into play for the member countries. The directive identified 22 predicate offences to look for. The 22 predicate offences constitute a roster of illicit acts that have the potential to generate illicit gains that can subsequently be employed in the process of money laundering. These predicate offences were established in the 6th Anti-Money Laundering Directive (6AMLD) and encompass the following:

- Terrorism

- Drug trafficking

- Arms trafficking

- Organized crime

- Kidnapping

- Extortion

- Counterfeiting currency

- Counterfeiting and piracy of products

- Environmental crimes

- Tax crimes

- Fraud

- Corruption

- Insider trading and market manipulation

- Bribery

- Cybercrime

- Copyright infringement

- Theft and robbery

- Human trafficking and migrant smuggling

- Sexual exploitation, including of children

- Illicit trafficking in cultural goods, including antiquities and works of art

- Illicit trafficking in hormonal substances and other growth promoters

- Illicit arms trafficking

The purpose of identifying these predicate offences is to enhance the ability of financial institutions and authorities in detecting, preventing, and investigating instances of money laundering. It is important to note that this list is not exhaustive, and European Union (EU) Member States have the discretion to designate additional criminal activities as predicate offences.

Transnational Nature: Challenges in Combating Predicate Offences

The transnational nature of predicate offences poses significant challenges in combating these crimes effectively. Criminal activities transcend borders, exploiting jurisdictional complexities and taking advantage of differences in legal frameworks. This cross-border nature makes tracing the illicit proceeds and prosecuting the offenders difficult.

Cooperation between law enforcement agencies and intelligence organizations becomes crucial in addressing these challenges. Sharing information, intelligence, and best practices among countries can enhance the effectiveness of investigations and prosecutions. It enables a coordinated response to dismantle transnational criminal networks involved in predicate offences.

Additionally, the development of specialized units and task forces dedicated to combating predicate offences fosters international collaboration. These units bring together experts from various jurisdictions, facilitating the exchange of knowledge, skills, and resources. By pooling their efforts, countries can better tackle the transnational aspects of these crimes.

Technological Advancements: Enhancing Detection and Prevention

Regulatory Compliance: Financial Institutions' Obligations

Technological advancements play a pivotal role in enabling financial institutions to meet their regulatory compliance obligations in the fight against predicate offences. These institutions are required to implement robust anti-money laundering (AML) measures to detect and prevent money laundering activities.

With advanced technologies, financial institutions can streamline their compliance processes and ensure adherence to regulatory frameworks. They can leverage sophisticated software solutions to automate the monitoring of customer transactions, identify potential red flags, and mitigate risks associated with predicate offences.

By deploying cutting-edge technologies, financial institutions can enhance their ability to detect suspicious activities, such as large cash transactions, complex money transfers, or transactions involving high-risk jurisdictions. These technologies enable them to analyze vast amounts of data in real time, flagging potential anomalies and facilitating timely reporting to regulatory authorities.

Know Your Customer (KYC) and Enhanced Due Diligence Measures

One of the critical components of AML compliance is the implementation of robust Know Your Customer (KYC) and enhanced due diligence measures by financial institutions. KYC procedures involve collecting and verifying customer information, ensuring the establishment of legitimate and transparent business relationships.

Technological advancements have revolutionized the KYC process, making it more efficient and accurate. Financial institutions can leverage digital identity verification tools, biometric authentication, and data analytics to verify the identities of their customers, assess their risk profiles, and ensure compliance with AML regulations.

Suspicious Transaction Reporting and Risk-Based Approaches

Financial institutions are required to implement robust mechanisms for reporting suspicious transactions to regulatory authorities. Technological advancements have facilitated the development of sophisticated transaction monitoring systems that can identify and flag potentially illicit activities.

By leveraging artificial intelligence and machine learning algorithms, financial institutions can analyze real-time transactional data, detecting patterns and anomalies indicative of money laundering or predicate offences. These technologies enable them to generate alerts for further investigation and reporting to the relevant authorities.

Moreover, risk-based approaches supported by advanced technologies allow financial institutions to allocate their resources effectively. They can prioritize high-risk customers or transactions, applying enhanced due diligence measures to mitigate the risks associated with predicate offences.

Financial Institutions' Vigilance: Anti-Money Laundering Measures

Raising Awareness: Educating Individuals about Predicate Offences

Financial institutions have a crucial role in raising awareness about predicate offences and their implications. By conducting educational campaigns and providing resources, they can help individuals understand the signs, risks, and consequences associated with money laundering activities.

Through various channels such as websites, brochures, and seminars, financial institutions can educate their customers about the importance of vigilance and their role in preventing predicate offences. By fostering a culture of awareness and responsibility, individuals can become better equipped to identify and report suspicious activities to the relevant authorities.

Red Flags: Recognizing Potential Predicate Offences

Financial institutions are well-positioned to identify red flags that may indicate potential predicate offences. By training their staff and implementing robust monitoring systems, they can effectively detect unusual or suspicious transactions that may be linked to money laundering activities.

Red flags can include transactions involving large cash amounts, frequent transfers to high-risk jurisdictions, sudden and unexplained changes in transaction patterns, or attempts to conceal the source of funds. By establishing comprehensive monitoring mechanisms, financial institutions can proactively identify and investigate such activities, contributing to the prevention of predicate offences.

Safeguarding Against Predicate Offences: Personal Preventive Measures

Individuals can take personal preventive measures to safeguard themselves against being unwittingly involved in predicate offences. Some recommended actions include:

- Exercising caution in financial transactions: Individuals should be mindful of any requests or offers that appear suspicious or involve unusual arrangements. It is essential to verify the legitimacy of the transaction and the counterparty involved.

- Protecting personal information: Safeguarding personal and financial information is crucial to prevent identity theft and unauthorized use of funds. Individuals should use strong passwords, secure their electronic devices, and be cautious while sharing sensitive information online or offline.

- Reporting suspicious activities: If individuals come across any transactions or activities that raise suspicion, it is important to report them to the relevant authorities or financial institutions. Prompt reporting can contribute to the timely detection and prevention of predicate offences.

By adopting these personal preventive measures, individuals can actively contribute to the fight against money laundering and predicate offences. Awareness, vigilance, and responsible financial behaviour can help create a safer and more secure financial environment for everyone.

Conclusion

The fight against money laundering and organized crime necessitates a deep understanding of predicate offences. Unveiling the intricacies of these crimes helps dismantle the web of illicit activities, preserve the integrity of financial systems, and safeguard societies. By strengthening global cooperation, leveraging technological advancements

Frequently Asked Questions (FAQs)

1. How are predicate offences linked to money laundering?

Predicate offences are crimes that generate proceeds that are subsequently laundered to make them appear legitimate. Money laundering involves the process of disguising the illicit origins of funds and integrating them into the legal economy. Predicate offences serve as the initial unlawful activities from which the illicit funds are derived. Money laundering enables criminals to enjoy the proceeds of their illegal activities while attempting to avoid detection by authorities.

2. Which industries are most vulnerable to predicate offences?

Several industries are particularly vulnerable to predicate offences and money laundering due to the nature of their operations and the potential for illicit financial transactions. Some of these industries include banking and financial services, real estate, legal and accounting services, casinos and gambling, precious metals and gemstones trading, and the art market. These sectors often deal with large sums of money, complex transactions, and high-value assets, making them attractive targets for money launderers.

3. What are the global efforts to combat predicate offences?

There are extensive global efforts to combat predicate offences and money laundering. International organizations, such as the Financial Action Task Force (FATF), set standards and guidelines for anti-money laundering and countering the financing of terrorism (AML/CFT) measures. Countries around the world have implemented legislation and established regulatory frameworks to enforce these standards and combat predicate offences. Additionally, international cooperation, information sharing, and mutual legal assistance agreements facilitate the coordination of efforts among jurisdictions to address cross-border challenges associated with predicate offences.

4. How can individuals protect themselves from predicate offences?

Individuals can take several measures to protect themselves from becoming victims or unwitting participants in predicate offences and money laundering schemes. These include:

- Being cautious of unsolicited offers or requests for financial transactions that seem suspicious or too good to be true.

- Verify individuals' or businesses' legitimacy and reputation before engaging in financial transactions with them.

- Safeguarding personal and financial information, including passwords and sensitive data, to prevent identity theft and fraudulent activities.

- Reporting any suspected money laundering activities or suspicious transactions to the appropriate authorities or financial institutions.

- Staying informed about the latest trends, red flags, and prevention techniques related to money laundering and predicate offences.

5. What is the punishment for engaging in predicate offences?

The punishment for engaging in predicate offences varies depending on the jurisdiction and the specific nature of the crime committed. In general, predicate offences are criminal activities in their own right, and individuals involved may face penalties such as fines, imprisonment, or both. The severity of the punishment often corresponds to the seriousness of the predicate offence and its impact on society. Additionally, individuals involved in money laundering, which is closely connected to predicate offences, may face additional charges and penalties related to laundering the proceeds of those crimes.

6. Can predicate offences be effectively eradicated?

While it may be challenging to eradicate predicate offences completely, significant progress can be made through comprehensive anti-money laundering measures, enhanced international cooperation, and continuous adaptation to evolving risks. Efforts to combat predicate offences include implementing robust regulatory frameworks, conducting thorough risk assessments, leveraging advanced technologies for detection and prevention, and fostering a culture of compliance and awareness among individuals and institutions.

Anti-Financial Crime Compliance with Tookitaki?

.png?width=250&height=104&name=PNG%20-%20Montserrat%20LOGO%20-%20a%20Thunes%20company%20(White).png)

-1.png?width=200&height=83&name=PNG%20-%20Montserrat%20LOGO%20-%20a%20Thunes%20company%20(White)-1.png)