The Most

Intelligent

Fraud Prevention

Platform

Collective Intelligence | High Performance

Our Impact (Annually)

5 Billion+

Transactions Monitored

400 Million+

Accounts Monitored

2 Million+

Alerts Processed

Partners Who Trust Us

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

.png?width=318&height=199&name=Customer%20Logos%20(1).png)

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

.png?width=318&height=199&name=Customer%20Logos%20(1).png)

- |

-

- |

-

- |

-

- |

Get 100% Risk Coverage with the help of Collective Intelligence

- Get access to a global Anti Financial Crime community that contributes the latest typologies

- Protect against fraud and money laundering techniques such as structuring, card frauds, chargebacks, Account takeover (ATO), Authorised Push Payments (APP Scams), money muling etc.

- Continuous updates to counter regulatory changes and new threats

Scale without Compromising on High Performance

- Process billions of transactions with >200 Transactions Per Second (TPS) rates

- Get 99.9% platform availability

Global Recognitions

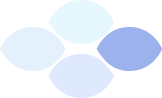

AMLS Solution

Tookitaki's AMLS is an end-to-end operating system that helps financial institutions detect and prevent financial crimes. It includes several modules such as Transaction Monitoring, Smart Screening, Customer Risk Scoring, and Case Manager. These modules work together to provide a comprehensive compliance solution that covers all aspects of AML including detection, investigation and reporting.

End-to-End AML Coverage from Onboarding to Offboarding

AMLS User Journey

What Do Our Customers Say?

-

Traditional Bank

-

Digital Bank

-

Payments

-

E-Wallet

Traditional Bank

Compliance Office of a Singapore Bank

-

50%

reduction in false positives -

~45%

reduction in overall compliance cost -

Digital Bank

For a new business like ours, Tookitaki's FinCense has been a perfect partner to help us effectively manage our compliance needs.

Digital Bank Client

.png?width=220&height=416&name=Group%2014246%20(1).png)

-

100%

Risk coverage for transactions

-

50%

Reduction in time to onboard to new scenario -

Payments

FinCense's ability to detect AML and fraud risk accurately in real time allows us to maintain the performance of the system at scale. It has been a game-changer for us.

Payment Services Client

.png?width=220&height=416&name=Group%2014246%20(2).png)

-

70%

Reduction in effort on threshold tuning and scenario testing -

90%

Reduction in false positives -

E-Wallet

Tookitaki helped us simplify our compliance operations by providing us with a single platform that effectively manages all fraud and AML processes.

E-Wallet Client

-

90%

Accuracy in high-quality alerts -

50%

Reduction in time to onboard to new scenario -

Our Thought Leadership Guides

Top 5 Transaction Fraud Risk Scenarios in Saudi Arabia

Top 5 Transaction Fraud Risk Scenarios in ASEAN

Navigating Screening Challenges: Part 2

Navigating AML Regulations in Singapore

Dynamic Risk Rating: The AI-Powered Future of CDD

Navigating Screening Challenges: Part 1

Choosing the Right AML Partner: Key Factors to Consider

AFC Ecosystem: Break Silos and Collaborate

Top AML Scenarios in Africa

Top AML Scenarios For Saudi Arabia

Typology Tales: Money Laundering Risks in Traditional Banks

Top Money Laundering Scenarios for ASEAN

Perpetual KYC - The Next Evolution in Risk-based Compliance

Typology Tales: High-Risk Countries and Customers

In this infographic, Tookitaki is featuring three typologies, contributed by one of our expert anti-financial crime professionals.

Typology Tales: Money Laundering Risks in Digital Banks

Prospect Screening in Real Time for Effective Risk Management

This e-book will provide an overview of prospect screening and explain the business case for real-time screening.

Automated Threshold Tuning for Optimal Alert Generation

Anti-Money Laundering (AML): A Guide for Banks and Fintechs

This e-book explores how banks and fintech companies can ensure AML compliance at a time when regulators change regulations.

Customer Due Diligence (CDD) for Banks and Fintech Companies

This guide explores the meaning of CDD, the importance of CDD, CDD methods and how financial institutions can build an effective CDD programmes.

The Paypers Financial Crime and Fraud Report 2023

The Role of Anti-Money Laundering Software in AML Compliance

This guide explores how technology can help financial institutions to manage anti-money laundering (AML) compliance.

Suspicious Activity Report (SAR): What You Need to Know

This e-book explores what constitutes a suspicious activity, who is required to file a SAR, and the SAR decision making process.

Typology Tales: Money Mules and Scams

Powering the Next-Gen of AML Technology with AI

Typology Tales: Loan Repayment

In this infographic, Tookitaki is featuring three typologies, contributed by one of our expert anti-financial crime professionals.

Money Laundering Risks in E-wallets and Digital Payments

.png?width=200&height=83&name=PNG%20-%20Montserrat%20LOGO%20-%20a%20Thunes%20company%20(White).png)